BCAA Home Insurance: What’s Covered?

Home is where we feel safest — it’s our personal haven. But protecting that haven from the unexpected is crucial. That’s where BCAA home insurance comes in. Whether you’re a homeowner, condo owner, or renter in British Columbia, BCAA offers tailored protection for your property, belongings, and liability needs.

In this detailed guide, we’ll walk through what BCAA home insurance covers, explore optional add-ons, clarify exclusions, and answer the most commonly asked questions to help you feel confident about your coverage.

Understanding BCAA Home Insurance

BCAA, or the British Columbia Automobile Association, is more than just an auto insurance provider. For decades, it has offered trusted home insurance policies to residents across the province. With over a million members, BCAA is known for reliable coverage, responsive customer service, and flexible options.

BCAA home insurance protects your home from a variety of risks — fires, floods, thefts, and accidents. The policies are designed to offer peace of mind whether you own a detached house, a condo, or you’re renting a unit.

What Does BCAA Home Insurance Cover?

Coverage for Your Home’s Structure

If you own a home, the physical structure is covered. This includes damage caused by fire, storms, falling trees, vandalism, and some types of water damage. If your home needs repair or rebuilding after a covered event, BCAA helps cover the costs.

For condo owners, the policy includes coverage for improvements you make inside your unit, such as flooring or upgraded kitchen fixtures, plus your share of damage to common property.

Personal Belongings Protection

Your home isn’t just walls and a roof — it holds your life’s possessions. BCAA home insurance covers your personal items like furniture, clothing, electronics, and appliances. If they’re stolen, damaged, or destroyed by a covered peril, you’ll be reimbursed based on replacement cost (not just current value).

Even belongings temporarily outside your home — such as a laptop in your car or your luggage on vacation — may be covered.

Liability Coverage

Accidents happen. If someone is injured on your property, or if you unintentionally cause damage to someone else’s property, BCAA’s liability coverage can help. This includes legal expenses, medical costs, and settlement payouts. Whether a guest slips on your icy driveway or your child breaks a neighbour’s window, liability protection is essential.

Additional Living Expenses

If your home becomes unlivable due to a covered event, BCAA home insurance covers additional living expenses. This can include hotel stays, meals, and transportation while your home is being repaired. It’s a vital part of keeping life moving when disaster strikes.

Optional Add-Ons and Endorsements

BCAA gives you the option to customize your coverage based on your lifestyle and property. Here are some common upgrades:

Earthquake Coverage

Since British Columbia is in a seismically active area, BCAA offers optional earthquake insurance. This covers structural damage, personal belongings, and extra living expenses following an earthquake. Earthquake coverage has a separate deductible, often a percentage of your home’s value.

Sewer Backup Protection

Sewer backups can cause serious and messy damage to your basement or lower levels. This optional add-on helps cover the cost of cleanup and repairs not typically included in a basic policy.

Flood and Overland Water Coverage

Flooding from rising rivers or melting snow isn’t usually part of standard coverage, but BCAA offers protection for overland water damage. This is especially important if you live near bodies of water or in low-lying areas.

Identity Theft Coverage

BCAA also provides optional identity theft coverage. It helps pay for recovery expenses such as legal fees and lost wages if your identity is stolen.

What’s Not Covered by BCAA Home Insurance?

Every policy has limits and exclusions, and understanding them is crucial.

Routine maintenance issues, wear and tear, mold from neglect, or damage caused by pests like rodents or termites are not covered. Damage from intentional acts, illegal activities, or war-related events is also excluded.

Additionally, certain high-value items like jewelry, artwork, or collectibles may have limited coverage unless you specifically schedule them with extra coverage.

How BCAA Tailors Coverage for Different Needs

BCAA home insurance adapts to different property types. Let’s look at how coverage varies:

For Homeowners

Full protection for the building, detached structures like garages or sheds, contents, liability, and additional living expenses.

For Condo Owners

Covers personal property, interior unit improvements, and loss assessment coverage to help with condo corporation claims that affect all unit owners.

For Renters

Even if you don’t own the property, BCAA offers contents and liability coverage, which protects your belongings and helps you in case of accidents or damages to the rental.

Why Choose BCAA Home Insurance?

BCAA is one of the most trusted insurance providers in British Columbia. Here’s why many residents choose BCAA home insurance:

- Competitive rates with member discounts

- Flexible policy options

- Responsive claims support available 24/7

- Optional green rebuild coverage (eco-friendly materials)

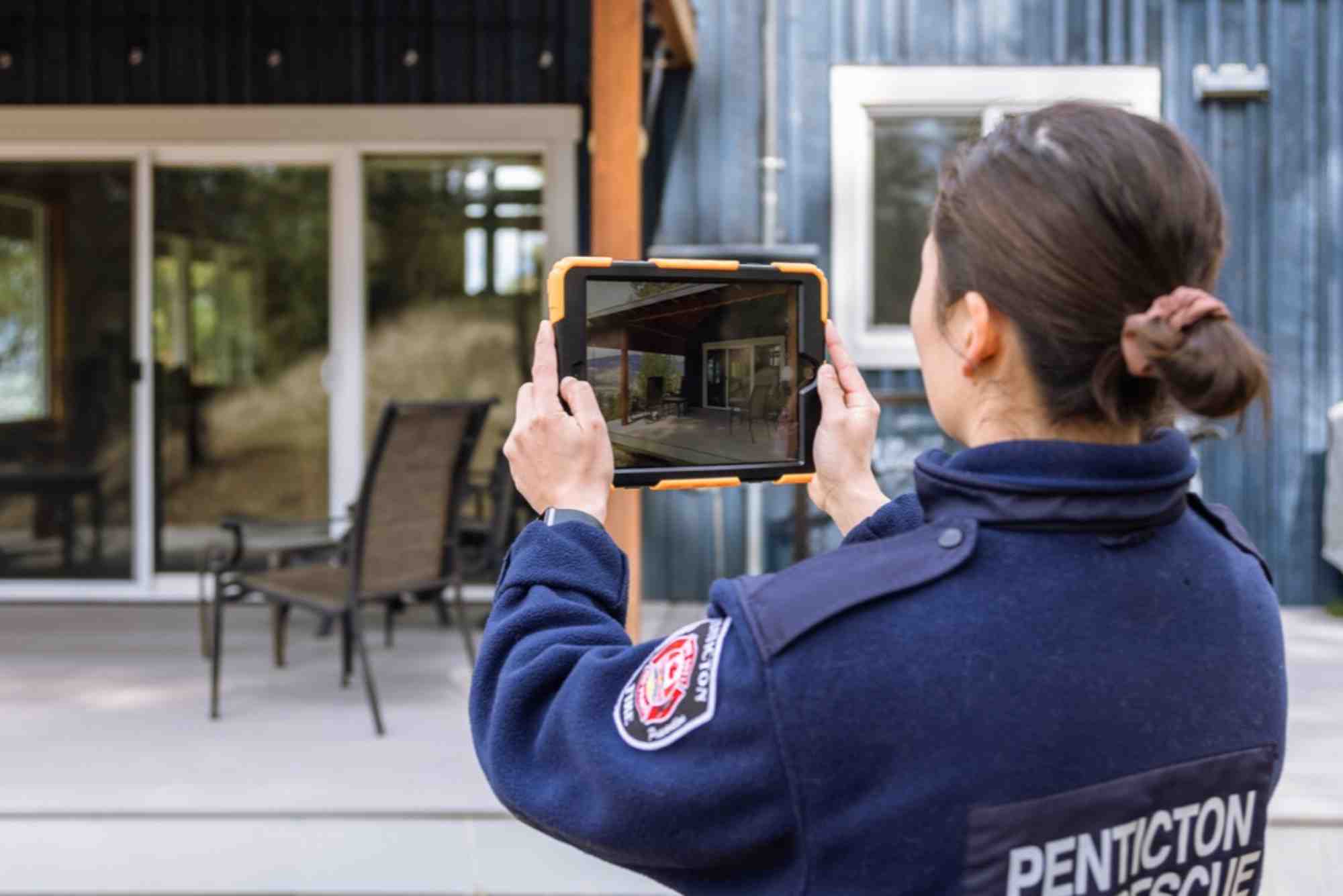

- Mobile app and digital tools for easy access

Plus, BCAA is a local organization that understands the unique needs of British Columbians — from coastal weather threats to seismic risks.

Tips to Maximize Your BCAA Home Insurance

Update your policy yearly to reflect home improvements or new purchases. Always keep an inventory of valuables and receipts if possible. And don’t forget to bundle your policies — BCAA offers discounts when you combine home and auto insurance.

Also, reviewing your deductible regularly can help you strike the right balance between monthly premiums and out-of-pocket risk during a claim.

FAQs

What is included in BCAA home insurance?

BCAA home insurance includes protection for your dwelling, personal belongings, liability, and additional living expenses. You can also add earthquake, sewer backup, and flood coverage.

Does BCAA cover mold damage?

Generally, mold caused by long-term neglect or moisture is not covered. However, if it results directly from a covered event (like a burst pipe), it may be partially covered.

Is earthquake insurance included in BCAA’s standard policy?

No. Earthquake coverage is optional and can be added for an additional premium. It’s recommended for many BC homeowners.

Can renters get BCAA home insurance?

Yes, renters can purchase tenant insurance that covers their belongings and personal liability, even if they don’t own the property.

Does BCAA offer replacement cost coverage?

Yes. BCAA typically reimburses claims based on the replacement cost of lost or damaged items, not their depreciated value.

How do I make a claim with BCAA home insurance?

You can file a claim online, via the mobile app, or by calling BCAA’s 24/7 claims line. Be prepared with photos, receipts, and any police or fire reports if applicable.