What Is a Company Code & Why It Matters

Understanding business structures can be tricky, especially when diving into the technical side of operations. One such crucial term is company code — a backbone in financial systems like SAP and a key identifier in global business operations. While it may seem like an internal detail, the company code affects everything from compliance to reporting.

This article explores what a company code is, its role in enterprise systems, why it matters for business accuracy, and how it streamlines processes across large organizations.

Understanding the Company Code

In simple terms, a company code is a unique identifier used by enterprise software systems to represent a legal entity within a company. It’s primarily used for accounting and financial reporting purposes. Think of it as a digital label assigned to each independent business unit within a larger organization.

In systems like SAP (Systems, Applications, and Products), the company code is the smallest unit for which a complete set of financial statements—like the balance sheet and profit & loss statement—can be generated.

The Purpose of a Company Code

A company code enables businesses to structure their operations into legally and financially distinct entities. Each company code has its own:

- Chart of accounts

- Fiscal year variant

- Tax configuration

- Legal reporting requirements

These features allow corporations to manage financial activities across different locations, countries, or divisions without losing clarity or control.

How Company Codes Work in ERP Systems

Enterprise Resource Planning (ERP) systems like SAP, Oracle, and Microsoft Dynamics use company codes as part of their organizational hierarchy. Here’s how it typically functions:

Company Code in SAP

In SAP, a company code is essential for all financial accounting activities. It defines where financial transactions are posted. For example, if a global enterprise operates in the US, UK, and Germany, each country can be assigned a separate company code to maintain compliance with local tax laws and accounting standards.

Example Scenario

Let’s say a corporation called “GlobalTextiles” operates in the US and India. They would set up:

- Company Code 1000 – GlobalTextiles USA

- Company Code 2000 – GlobalTextiles India

All financial postings, tax reports, and local compliance are tracked separately under these codes, but consolidated when needed at the group level.

Why the Company Code Matters

You might wonder why this layer of complexity is necessary. Here’s why the company code is indispensable in modern business:

Legal Compliance

Each company code reflects a legally independent entity. This allows a business to fulfill local tax requirements, labor laws, and financial reporting obligations independently of its other operations.

Accurate Financial Reporting

Since financial transactions are recorded per company code, businesses can generate precise financial statements for each entity. This ensures stakeholders get a clear picture of performance at the legal-entity level.

Simplified Audits

Auditors can review a company’s records in a clean, structured way because all financial transactions are grouped by company code. It also helps track any irregularities or discrepancies to a specific business unit.

Better Decision-Making

CFOs and business leaders benefit from having data segmented by company code. It allows them to analyze profitability, operational efficiency, and investment opportunities by region or subsidiary.

Scalability and Growth

Adding new company codes when entering a new market is far easier than restructuring your entire accounting system. It supports global expansion without disrupting existing operations.

Key Elements Tied to a Company Code

To fully understand a company code, you should also know the components it typically interacts with:

General Ledger (G/L)

All financial postings—revenues, expenses, assets—are managed at the company code level in the general ledger.

Cost Centers and Profit Centers

While company codes handle legal reporting, cost centers and profit centers are more focused on internal reporting and performance tracking.

Vendor and Customer Master Data

Vendors and customers are linked to specific company codes, ensuring the right financial documents and transactions are tracked accordingly.

Plant and Storage Locations

In systems that manage logistics or production (like SAP), plants or warehouses are tied to a specific company code to manage material movement and valuation.

Best Practices for Managing Company Codes

Managing company codes properly is critical to avoid financial errors and compliance issues. Here are some tips:

- Align each company code with a legal entity

- Standardize the naming conventions and number ranges

- Ensure tax configurations comply with local regulations

- Periodically review company code usage and deactivate dormant ones

- Set up appropriate user access controls per code to prevent data leaks

Common Mistakes Businesses Make with Company Codes

Many organizations struggle with overcomplication or mismanagement of company codes. Some examples include:

- Creating too many company codes for minor differences

- Not properly aligning company codes with legal registration

- Using the same code for different geographical entities

- Ignoring localization requirements such as tax laws or currency

Avoiding these pitfalls ensures long-term clarity and easier audits.

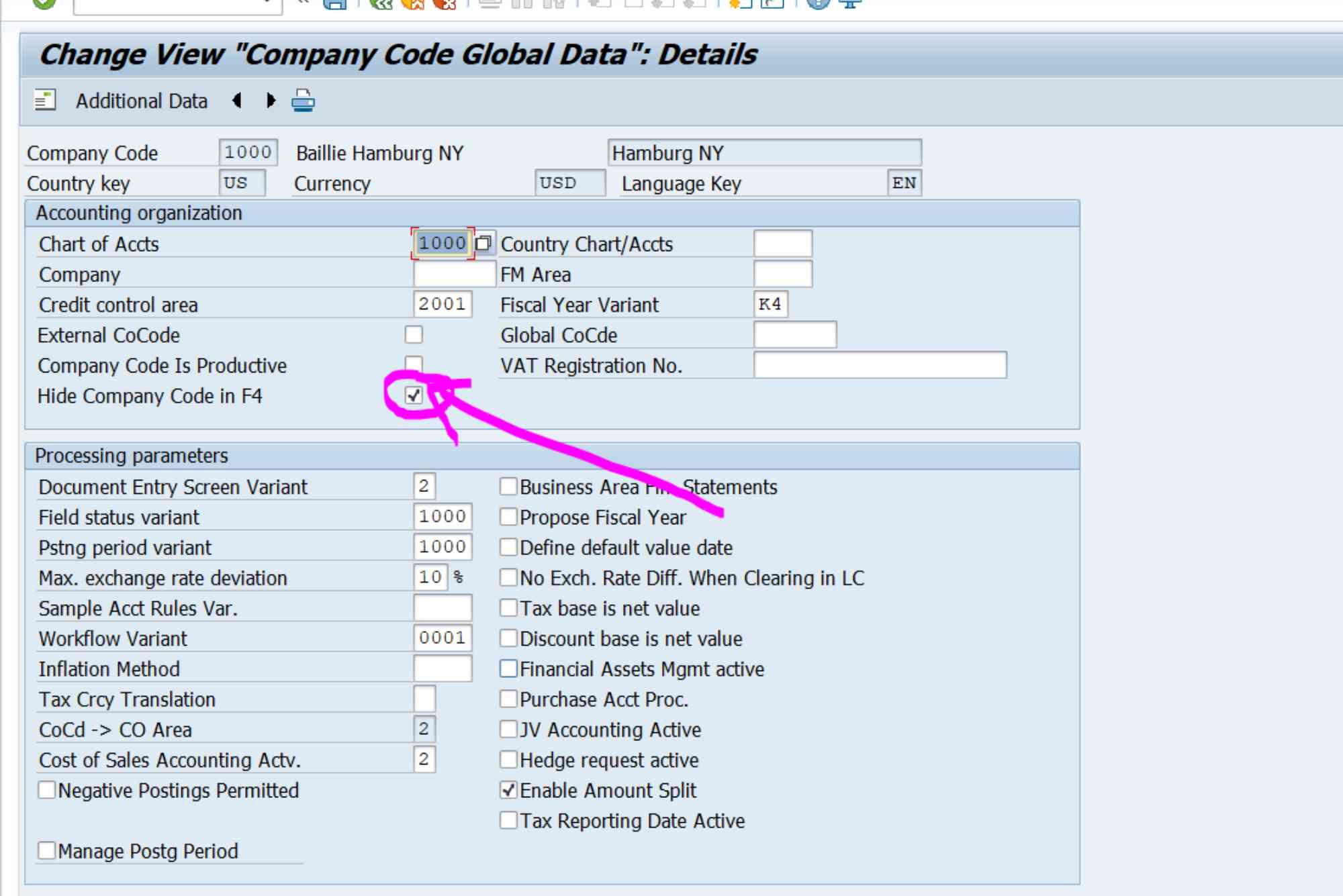

How to Create a Company Code (SAP Example)

In SAP, creating a company code typically involves:

- Defining the company code: Assign a four-digit alphanumeric identifier.

- Setting up local currency: Choose the functional currency.

- Assigning a chart of accounts: Determine which accounts will be used.

- Configuring fiscal year variant: Define how periods are managed.

- Entering address and tax information: Include VAT registration, tax codes, etc.

Once set up, the code is used across modules such as finance (FI), materials management (MM), and sales (SD).

Real-World Applications of Company Code

Company codes are used across industries to maintain order in multinational operations:

- Retail: To manage region-specific inventory and revenues

- Manufacturing: For plant-specific cost accounting

- Pharmaceuticals: To handle country-specific compliance

- Banking: For managing branch-specific financials under the same corporate umbrella

Frequently Asked Questions

What is a company code in SAP?

In SAP, a company code is the smallest organizational unit for which you can maintain a legal set of books. It represents an independent legal entity for financial reporting.

Is company code mandatory in ERP systems?

Yes, most ERP systems require a company code to post financial transactions and generate accurate financial statements.

Can a company have multiple company codes?

Yes, especially multinational companies. Each legal entity or geographic operation can be assigned a unique company code.

What’s the difference between a company and a company code?

A “company” may refer to a group or a holding structure, while a company code refers specifically to a legal entity within that group used for financial accounting.

How many digits is a company code?

In SAP, a company code is typically a four-character alphanumeric identifier, although this can vary by system.